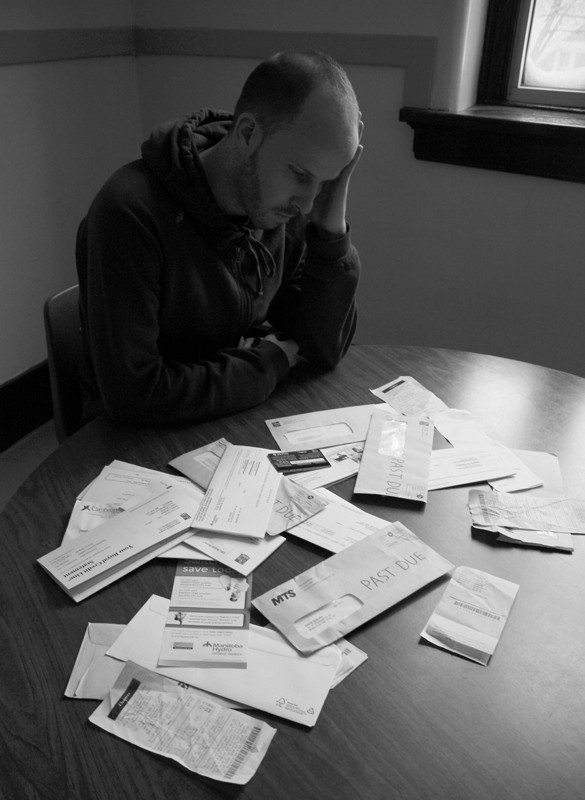

Beware of debt reduction schemes, agency warns

May make debt problems worse

Some debt reduction businesses may be promising more than they can deliver, according to the Manitoba Consumer Protection Office.

On Nov. 7, the provincial government consumer watchdog issued a warning urging Manitobans to be wary of promises that their debts can be cut by up to 60 per cent.

Dealing with these businesses could end up digging people deeper into debt, a press release warned.

Although debt-related services have been around for a long time, the new warning concerns a newer model of debt management that has sprung up over the past year or two, Jan Forster, director of the Consumer Protection Office, said.

Forster says she has been hearing more and more complaints to her office and concerns within the debt management community.

“We wanted to make sure that consumers fully understand how the model works, and then they can make informed choices about whether or not this type of service is best for them,” Forster said.

In the debt settlement model, people sign a contract, pay significant up-front fees, and then the agency tells them to stop paying their creditors and start saving funds in a separate account. Once they’ve saved enough, the agency will go to creditors and try to negotiate to reduce the amount owing.

Ken Jones of E Z Debt Relief, a company offering to cut debt by up to 60 per cent, said debt reduction companies can’t put people further into debt.

“Absolutely not,” he said. “Because the whole process of debt settlement is reducing the debt from the initial balance.”

Forster points out that debt settlement contracts actually state that there are no guarantees. And some creditors may refuse to work with the agencies.

“Also, the fact that you stopped paying your minimum monthly payment to your creditors means that your credit score is going to be negatively impacted, and collection agencies and your creditors are still going to be calling you,” Forster said.

Jones denied credit ratings could be damaged through this approach.

“That doesn’t actually happen. The money is secure in an account under their name. So the money is not going anywhere,” he said.

The Winnipeg Credit Counselling Society is one of many non-profit organizations offering help for those overwhelmed by debt.

President Scott Hannah said the organization looks at all options, as opposed to the one-size-fits-all approach of debt settlement companies.

Some people at an early stage of financial trouble just need help establishing a budget, without making it so restrictive that it incites rebellion. Others may be able to consolidate their debts through their bank or credit union, he said.

For those who owe too much to get help from their bank, Hannah’s organization can negotiate with creditors to stop charging interest and get the debt to a manageable level.

The difference, Hannah said, is that because of well-established relationships, their acceptance rate with creditors is over 99 per cent.

“The acceptance rate of these debt settlement companies is less than five per cent,” Hannah said.

For help finding financial counseling support, contact the Consumer Protection Office at 204-945-3800 or email [email protected].

Published in Volume 66, Number 13 of The Uniter (November 23, 2011)