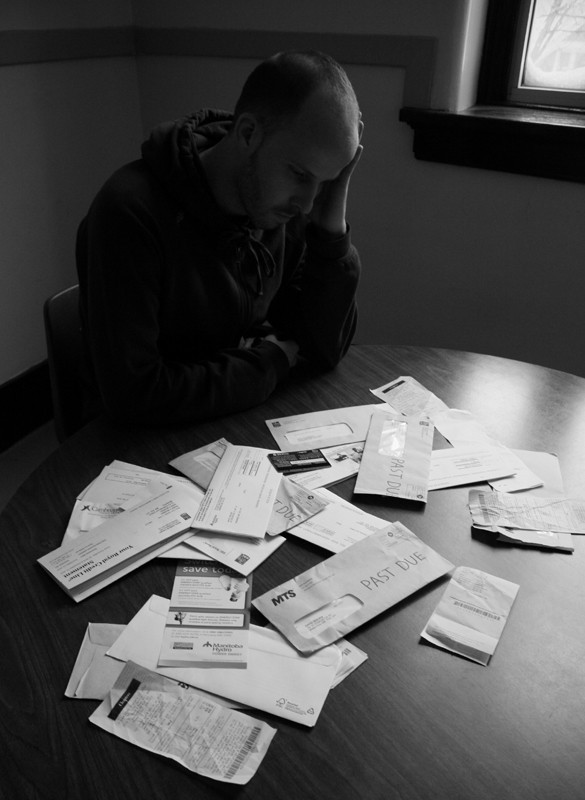

Bankruptcy may not be all that bad

Misconceptions about what it means to be bankrupt and how to avoid it

Often perceived as the end of the road, bankruptcy may not be the worst option for someone who is struggling with debt.

“The question of how much debt is too much varies. (Bankruptcy is) just when it gets to the point where you can’t handle your debts,” said Bruce Caplan, senior vice-president of BDO Canada Ltd., a financial services and advisory firm. “In order to file an assignment in bankruptcy, it must be a debt of $1,000 or more.”

The fee to file for bankruptcy is $75. Afterwards, a trust fund is made in the debtor’s name in which assets, garnisheed cheques and tax returns are taken to pay fees to the trustee and sometimes a return to the creditor.

The creditors may not receive anything when a person declares bankruptcy and they write it off, said Leigh C. Taylor, bankruptcy trustee at L.C. Taylor & Co. Ltd, a Winnipeg-based debt expert firm.

He added that it’s the cost of doing business, which is one of the reasons creditors charge 14 to 18 per cent interest; they have to cover their losses.

Those who do get stuck paying off the minimum payment on their credit card are providing good business to the creditors.

“The best way to avoid bankruptcy is to avoid credit,” said Caplan. “It’s so easy to get a credit card and make a minimum payment without realizing how much it costs.”

Caplan explained that bankruptcy’s stigma has changed over the past 60 years since the Bankruptcy and Insolvency Act was put into place.

According to Caplan, it is more acceptable for a person to declare bankruptcy today.

“If people are going out and running up their credit cards and then taking advantage of the system, then that is absolutely wrong,” he said. “(But) if you get into a difficult situation, there is absolutely no shame in it.”

“ No paycheque comes with instructions on what to do.

Christi Quinn, credit counsellor

Taylor echoes Caplan in saying that bankruptcy is not necessarily a problem.

“Bankruptcy is a solution, but sometimes there may be an easier solution,” he said.

According to Holly Toupin, regional vice-president for the central Winnipeg area with the Royal Bank of Canada, bankruptcy should not be the first choice.

“Bankruptcy should always be a last resort,” said Toupin.

“The biggest implication of bankruptcy is that it will normally stay on your credit bureau for a period of six years,” she added.

This can affect the process of renting an apartment, getting a job and applying for a loan from the bank.

Without rebuilding credit, a person can be affected by the bankruptcy for a long time.

Taylor encourages budget management as the easiest way to handle a person’s debt or rebuild credit.

“If you spend less than you make, no problem; if you spend more than you make, eventually you’re going to have a problem. Limit your lattes to one a day. That pocket change adds up,” he said.

But without proper education on budget management or managing credit, a lot of people are left lost.

“No paycheque comes with instructions on what to do,” said Christi Quinn, a credit counsellor for the Credit Counselling Society in Winnipeg.

Quinn encourages a person to always seek out financial advice and to receive a second opinion from an unbiased source.

“(Bankruptcy) never really disappears,” said Quinn. “If you go to be bankrupt again it will show up and you will be affected for up to twice as long.”

Published in Volume 65, Number 18 of The Uniter (February 3, 2011)